Okay, so I finally got my hands on the Mighty Oak Debit Card, and let me tell you, the process was a bit of a rollercoaster. I figured I’d share my experience, the good, the bad, and the downright confusing.

First things first, I heard about this card through a friend who swore up and down that it was the best thing since sliced bread for earning rewards. Naturally, I was skeptical, but the promise of potentially getting some decent cashback on my everyday spending was too tempting to ignore.

Step 1: Application Process

I jumped onto their website, which, I gotta say, looked pretty slick. The application was straightforward enough. Name, address, social security number – the usual drill. I filled everything out, double-checked it (because who wants to get rejected for a typo?), and hit submit.

I waited…and waited…and waited some more. It took about a week before I heard anything back. I was starting to think I’d been ghosted, but then an email popped up in my inbox saying I was approved! Yay!

Step 2: Receiving the Card

They said the card would arrive in 7-10 business days. Honestly, it felt like an eternity. I was checking my mailbox every single day like a kid waiting for Christmas. Finally, after about 8 days, there it was! A plain white envelope with the Mighty Oak logo. Nothing fancy, but I ripped it open like I’d won the lottery.

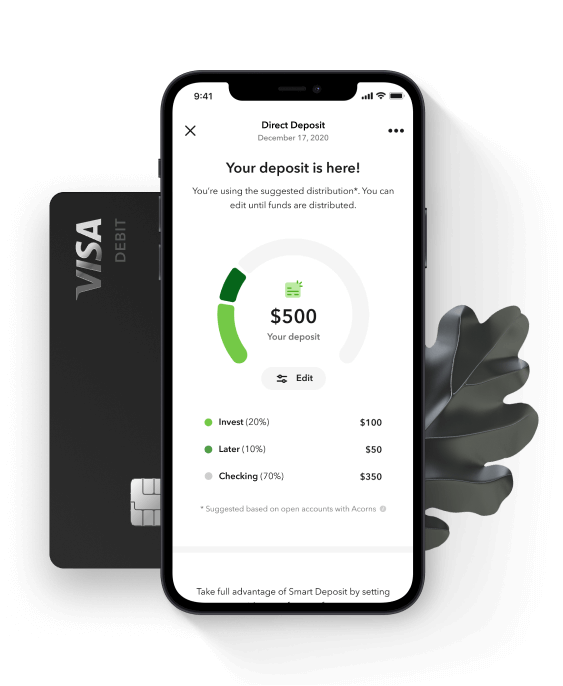

Step 3: Activation and Account Setup

The card came with instructions on how to activate it. You could either call a number or do it online. Being the modern person I am, I opted for the online route. The activation process was painless. I created an account, set up my PIN, and linked it to my bank account. So far, so good.

Step 4: Using the Card and Earning Rewards

This is where things got a little…interesting. The card supposedly gives you cashback on certain categories, but figuring out which categories qualify was like trying to solve a riddle wrapped in an enigma. The website wasn’t super clear, and I spent a good chunk of time trying to decipher their terms and conditions.

I started using the card for everything: groceries, gas, coffee, even my Netflix subscription. I was carefully tracking my spending to see which purchases would trigger the rewards. After a month, I logged in to check my cashback balance. Let’s just say it wasn’t as impressive as I’d hoped. It seemed like only a fraction of my purchases actually qualified for the advertised rewards.

Step 5: Customer Service (The Not-So-Fun Part)

I decided to reach out to their customer service to get some clarification on the rewards program. This is where my experience took a nosedive. I tried calling, but was put on hold for ages. Eventually, I gave up and sent an email. It took them three days to respond, and the response wasn’t exactly helpful. It was a generic canned answer that didn’t address my specific questions.

I ended up having to send multiple emails back and forth before I finally got a somewhat clear explanation. Turns out, the categories are very specific, and many of my purchases didn’t fall into those categories. Lesson learned: read the fine print!

Final Thoughts

Would I recommend the Mighty Oak Debit Card? It’s a mixed bag. The application and activation process were smooth, but the rewards program is confusing, and the customer service is lacking. If you’re willing to put in the effort to understand the ins and outs of the rewards categories, you might be able to squeeze some value out of it. But honestly, there are probably better cashback options out there that are less of a hassle.

- Pros: Easy application, relatively quick card delivery.

- Cons: Confusing rewards program, subpar customer service.

Ultimately, I’m not sure if the Mighty Oak Debit Card is worth the effort. I might keep using it for a while to see if I can optimize my spending to maximize the rewards, but I’m not holding my breath.

That’s my experience in a nutshell. Hopefully, this helps you make an informed decision if you’re considering getting one yourself.