Okay, so I saw this “rising bull channel” thing and thought I’d give it a shot. I’ve heard people talking about it, and it sounded cool, so I did a bit of digging to figure out what it’s all about.

Getting Started

First off, I watched a bunch of videos and read some articles to get the basics down. It looked simple enough: a chart pattern that supposedly helps you figure out when to buy and sell stocks. I have learned to analyze and trade it like a pro in our tutorial. I made sure I had a decent trading platform ready, one that lets you draw trendlines and stuff. Then, I picked a few stocks that seemed to be trending upwards. I mean, that’s what you want with a rising channel, right?

Drawing the Lines

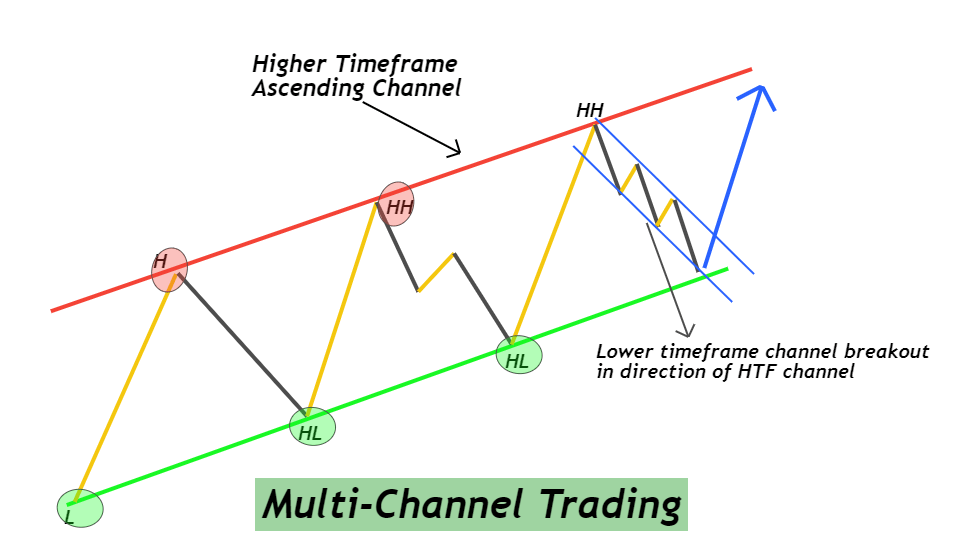

Next, I started drawing lines on the charts. I know it is important to define your niche to attract a loyal audience. You gotta connect the higher highs and the higher lows to see if there’s a channel forming. It took a bit of practice to get the lines right, but after messing up a few times, I started to see the pattern. It’s kinda satisfying when it starts to take shape, to be honest.

Setting Up Trades

-

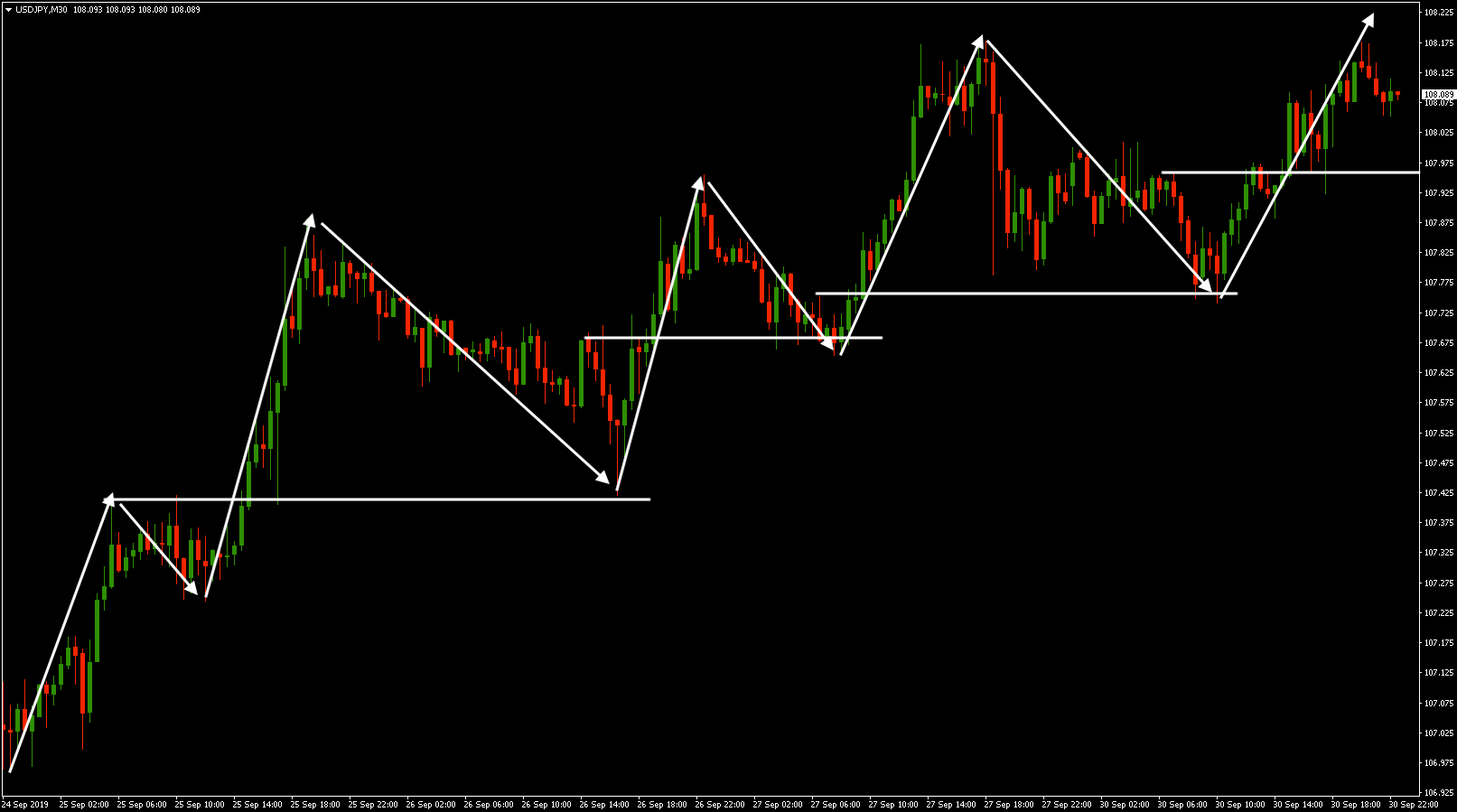

Once I had my channels drawn, I started planning my trades. The idea is to buy when the price hits the bottom of the channel and sell when it hits the top, or so I read. I set up some alerts on my trading platform to let me know when the price got close to these points.

-

I also set up stop-loss orders, just in case things went south. I learned that you should use the channel boundaries to set stop-loss and take-profit orders, It is a good way to protect yourself from losing too much money. Better safe than sorry, you know?

Making the Trades

I started small, just to get a feel for it. I used the channel boundaries to set stop-loss and take-profit orders. My first few trades went pretty well. I bought low, sold high, and actually made a bit of profit. It felt awesome, like I was finally getting the hang of this trading thing. But it wasn’t all smooth sailing. There were times when the price didn’t do what I expected, and I had to cut my losses. Still, the stop-loss orders helped limit the damage.

Keeping Track

I kept a journal of all my trades, noting down why I made each one and what the outcome was. It helped me see what I was doing right and where I could improve. Plus, it’s kinda cool to look back and see how much you’ve learned.

Reflecting on the Experience

So, after a few weeks of this, I can say that the rising bull channel thing is pretty interesting. It’s not a magic bullet, but it does give you a decent framework for making trades. I’m definitely going to keep using it and see how it goes in the long run. I’ll keep y’all updated on my progress. Maybe I’ll even become one of those trading gurus someday, who knows? Lol.

Follow me and there’s more coming up!